XRP Price Prediction: $4 Target in Sight as Bulls Take Control

#XRP

- ETF Approval Potential: October 2025 timeline could accelerate institutional demand.

- Ripple's Expansion: $200M Rail acquisition strengthens payment infrastructure.

- Regulatory Clarity: SEC case resolution removes a major overhang.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

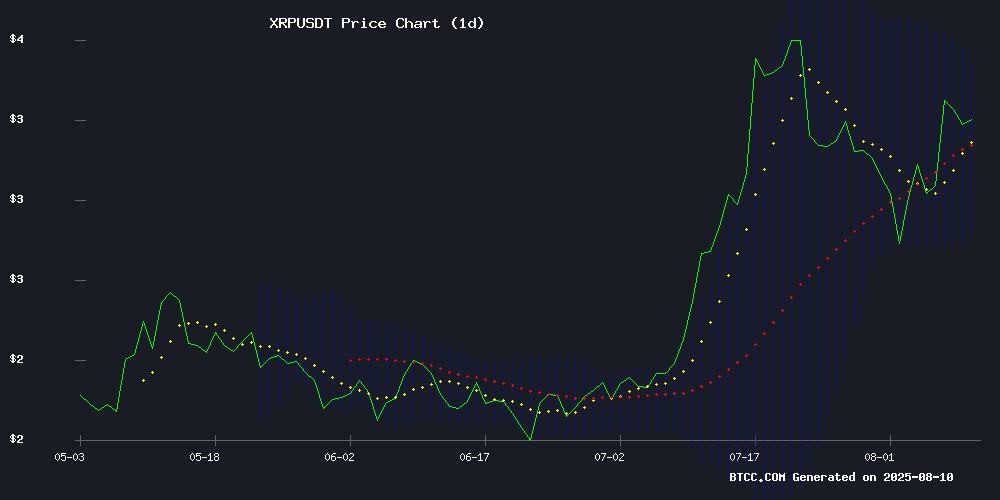

According to BTCC financial analyst Robert, XRP is currently trading at 3.2723 USDT, above its 20-day moving average of 3.1302, indicating a bullish trend. The MACD shows a positive crossover with values at 0.1288 (MACD line), 0.0853 (signal line), and 0.0435 (histogram). Bollinger Bands suggest moderate volatility with the price NEAR the upper band (3.4583), signaling potential upward momentum. Robert notes that if XRP maintains support above the middle band (3.1302), a test of the upper band is likely.

XRP Market Sentiment: Strong Bullish Catalysts Ahead

BTCC financial analyst Robert highlights several bullish factors for XRP, including the potential approval of an XRP Spot ETF in October 2025, Ripple's acquisition of Rail for $200M to bolster stablecoin infrastructure, and the resolution of the SEC case. Whale activity and a golden cross in the MVRV ratio further support upside potential. However, Robert cautions that exchange inflows and overbought signals may prompt short-term corrections before a sustained rally toward $4.

Factors Influencing XRP’s Price

XRP Spot ETF: 3 Bullish Factors for October 2025 Approval

The path to an XRP ETF is gaining momentum as the SEC reviews multiple proposals, with October 2025 emerging as a potential turning point. Legal clarity, corporate developments, and technical progress are converging to create a favorable environment for approval.

The resolution of Ripple's long-running lawsuit with the SEC removes a major regulatory overhang. After nearly five years of litigation, both parties have dismissed pending appeals, providing much-needed clarity on XRP's status. This development directly addresses one of the SEC's primary concerns regarding classification.

Market participants are increasingly optimistic about the prospects for an XRP ETF. While no guarantee, the combination of legal resolution, growing institutional interest, and technical readiness suggests the stars may be aligning for a 2025 approval.

XRP Price Today: XRP Hits $3.35 as MVRV Ratio Golden Cross Signals Strong Upside

XRP surged to $3.35 amid a bullish technical setup, with its MVRV ratio flashing a golden cross for the third time since November 2024. Historical data suggests this signal has preceded rallies of 630% and 54%, fueling speculation of another major price run.

Market analyst Ali Martinez notes aggressive whale accumulation and growing corporate adoption are compounding the positive momentum. Traders are eyeing resistance levels, recalling XRP's past explosive moves above $2 and $3 following similar patterns.

The current setup emerges after XRP recovered from a dip below $3 earlier this month. Analysts are modeling three potential scenarios, including a repeat of the 630% surge seen in late 2024.

Is XRP Price Gearing Up For $20 Breakout As Ripple Whales Bag 50M Coin?

XRP price has surged past $3.3, reigniting investor interest following the conclusion of the Ripple vs. SEC lawsuit. The legal resolution has bolstered market confidence, with whales accumulating 50 million coins amid the rally.

Trading volume declined 59% to $5.35 billion, yet weekly gains hit 13%, with a 35% monthly jump. Analysts point to a technical indicator that previously preceded a 630% price surge, suggesting potential for further upside.

Crypto VC Funding Surges with $1.46B Raised Across 18 Projects

Institutional investors are doubling down on blockchain infrastructure, with $1.46 billion flowing into crypto ventures during the first week of August. The TON ecosystem dominated headlines as Verb Technology secured a staggering $558 million raise, backed by heavyweights like Kingsway Capital and Blockchain.com. Meanwhile, Ripple's $200 million acquisition of Rail signals aggressive expansion into fiat-stablecoin payment rails.

Convergence plays between AI and blockchain attracted outsized checks, with UK-listed Satsuma Technology pulling $217.6 million from Pantera and Haun Ventures. The funding frenzy underscores growing institutional conviction in next-generation crypto applications, particularly those bridging decentralized networks with artificial intelligence and traditional payment systems.

Ripple Acquires Rail for $200M to Strengthen Stablecoin Payments Infrastructure

Ripple has announced a strategic $200 million acquisition of Rail, a payments platform specializing in stablecoin transactions, as part of its push to dominate the global stablecoin payments market. The deal, disclosed on August 7, 2025, is expected to close in Q4 pending regulatory approvals.

The acquisition will integrate Rail's technology into Ripple's ecosystem, creating a next-generation stablecoin network with real-time settlement, global reach, and institutional-grade compliance features. Ripple CEO Brad Garlinghouse touted the combined entity as the future go-to provider for financial institutions seeking stablecoin infrastructure.

The move signals Ripple's aggressive expansion in stablecoin solutions amid growing institutional demand for blockchain-based payment systems. The combined platform promises always-on infrastructure, advanced API integration, and automation to replace legacy financial processes.

XRP Charts Signal Caution Amid Bullish Momentum

XRP surged 11% on Thursday, breaking out of a bull flag pattern, but faces stiff resistance at $3.65—a level marked by a bearish tweezer top candlestick pattern last month. The rejection at this price point signals significant selling pressure, with on-chain data revealing elevated unrealized profits that could trigger a correction.

Alphractal notes the NUPL metric mirrors 2018 and 2021 peaks, historically preceding distribution phases. Bulls must reclaim $3.65 to invalidate the bearish structure, but profit-taking looms as a headwind.

Key levels to watch: Resistance at $3.38, $3.65, and $4.00; support at $2.99, $2.72, and $2.65.

XRP Price Targets $4 Following SEC Case Resolution and Whale Activity

Ripple's XRP surged 11% to $3.30 after a $125 million settlement ended its five-year legal battle with the SEC. The resolution removes regulatory uncertainty that had plagued the token since 2020, when the SEC alleged institutional sales constituted unregistered securities offerings.

Despite a $1.9 billion whale sell-off, XRP's market cap rebounded above $180 billion as futures volume spiked 200%. Analysts highlight the settlement's significance for institutional adoption, with JP Morgan's 2021 mass adoption prediction now materializing above the $3.30 threshold.

The agreement restricts Ripple's institutional sales but provides the clarity financial institutions require. Market reaction suggests renewed confidence, with XRP outperforming major assets in the immediate aftermath.

XRP Whale Activity Signals Potential Price Correction Amid Exchange Inflows

XRP faces mounting selling pressure as large holders accelerate transfers to exchanges, according to CryptoQuant data. The 30-day moving average of whale deposits surged from 141 million to 260 million XRP between July and August—a pattern historically preceding downturns.

Julio Moreno, Head of Research at CryptoQuant, highlights the correlation between exchange inflows and impending sell-offs. "Sudden whale movements often mark inflection points," he notes, referencing XRP's 10% single-day rally last month that peaked at $3.29 before the current cautionary signals emerged.

Market participants monitor such flows as a liquidity barometer. Exchange-bound transfers typically foreshadow distribution phases, while withdrawals suggest accumulation. The current trend mirrors behaviors seen during previous XRP corrections, putting traders on high alert.

VivoPower Aims to Become the First US Firm to Offer Exposure in Ripple and XRP

VivoPower International PLC, a Nasdaq-listed solar power company, announced plans to purchase $100 million worth of Ripple Labs shares. The move is part of a strategy to expand its XRP-focused digital asset treasury, securing tokens at an 86% discount to market prices.

Shares of VivoPower surged 32% following the announcement, reflecting investor confidence in the bold bet. Executive Chairman Kevin Chin framed the initiative as a sustainable treasury model with significant upside potential.

The deal provides indirect XRP exposure at approximately $0.47 per token. Former Ripple board member Adam Traidman highlighted additional benefits, including stakes in Ripple's RLUSD stablecoin and business units like Hidden Road and Metaco.

Trump Ends 'Debanking' Policy as SEC Closes Ripple Case

President Donald Trump has signed an executive order prohibiting banks from denying services based on political or religious affiliations. The move eliminates the controversial 'reputation risk' rule that critics argue was used to exclude crypto firms from traditional banking. JPMorgan and Bank of America faced direct accusations from Trump, though both institutions deny politically motivated account closures.

In a separate development, the SEC has concluded its landmark case against Ripple Labs. While maintaining a $125 million fine and institutional sales restrictions, the regulator removed the 'Bad Actor' designation. This allows Ripple to resume fundraising through Regulation D offerings for accredited investors, marking a significant thaw in the SEC's stance toward crypto enterprises.

SEC and Ripple End Legal Battle, XRP Ruling Becomes Final

The U.S. Securities and Exchange Commission (SEC) and Ripple Labs have concluded their prolonged legal dispute, with both parties agreeing to dismiss their respective appeals. This finalizes a pivotal 2023 court decision that categorized XRP token sales into securities and non-securities transactions. The resolution has propelled XRP's price up by over 10% in the past 24 hours, reaching $3.31.

A joint filing submitted to the U.S. Court of Appeals for the Second Circuit confirmed the dismissal of appeals, with each party covering its own legal costs. The case, which began in December 2020, has significantly influenced the interpretation of crypto assets under U.S. securities law.

As part of the settlement, Ripple will pay a $125 million civil penalty, with funds released to the U.S. Treasury now that the case is closed. A permanent injunction remains, barring Ripple from selling XRP to institutional investors—a central issue in the litigation.

The 2023 ruling by U.S. District Judge Analisa Torres stands, affirming that XRP sales to institutional clients constituted securities offerings while other sales did not. This landmark decision provides clarity for the crypto industry amid ongoing regulatory scrutiny.

How High Will XRP Price Go?

Robert projects XRP could reach $4 in the near term, driven by technical strength and positive catalysts. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | 3.1302 | Support level |

| Bollinger Upper | 3.4583 | Next resistance |

| MACD Histogram | 0.0435 | Bullish momentum |